Defer Capital Gains with a 1031 Exchange

Olympic Exchange Accommodators provides professional qualified intermediary services to real estate investors across South King, Pierce, Thurston, Kitsap counties and the Wenatchee area. Keep more of your investment working for you.

Why Choose Olympic Exchange?

Trusted guidance through every step of your tax-deferred exchange, backed by legal expertise and certified professionalism.

Secure Fund Management

Your exchange funds are held in Qualified Escrow Accounts with dual signature requirements for maximum security.

Expert Timeline Management

We ensure strict compliance with 45-day identification and 180-day exchange deadlines.

Complete Documentation

Comprehensive exchange documentation and IRS-compliant reporting for peace of mind.

All Property Types

Forward, reverse, and improvement exchanges for residential, commercial, and land investments.

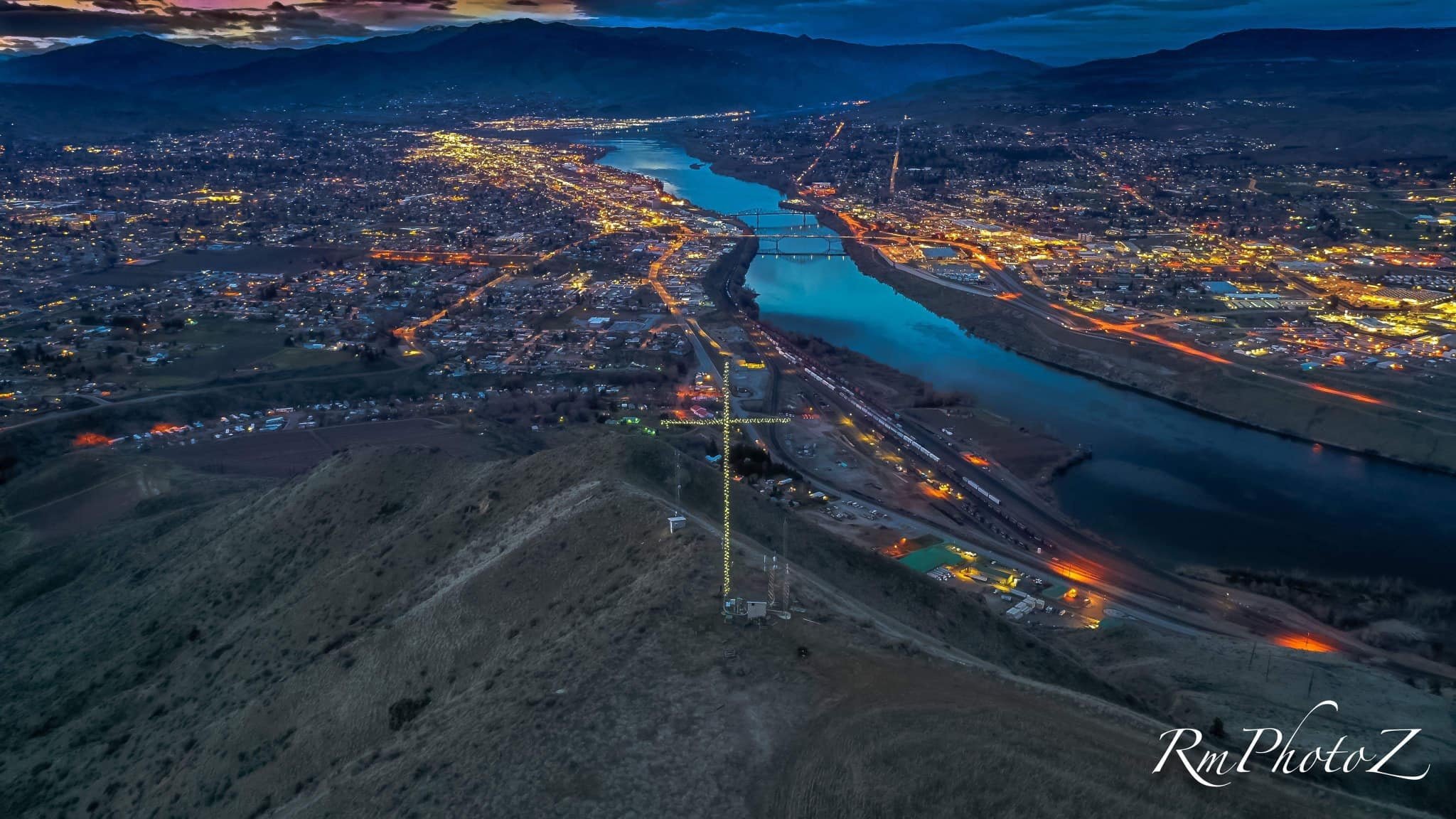

Serving Washington's Growing Markets

Local expertise in South King, Pierce, Thurston, and Kitsap counties, plus the Wenatchee area. We understand the unique real estate opportunities in your region.

Know Your Critical Deadlines

The success of your 1031 exchange depends on meeting two strict deadlines that cannot be extended:

Day Identification Period

You must identify potential replacement properties in writing within 45 days of your sale closing.

Day Exchange Period

You must close on your replacement property within 180 days of your sale closing.

1031 Exchange Deadline Calculator

Calculate your critical 45-day and 180-day deadlines

Ready to Defer Your Capital Gains?

Contact us today for a free consultation. We'll help you understand your options and guide you through a successful 1031 exchange.